Description

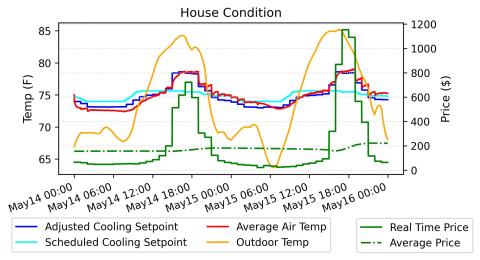

Real time pricing (RTP) is often promoted as a mechanism to improve the economic efficiency of the electricity system. However, many regulators have been hesitant to adopt RTP due to concerns about exposing customers to extreme price swings. To balance these concerns, this paper proposes a methodology for establishing price controls, based on the supply of demand-side flexibility in the system. As an illustrative example, we measure price responsiveness using an agent-based simulation model that is representative of the ERCOT market. The model is composed of a distribution feeder that has 250 customers with active agents controlling their HVAC systems in response to the historical ERCOT RTP with an artificially added high-price event. These agents are subjected to increasing electricity prices during the event, which we then use to create a supply curve for demand-side resources in our modeled scarcity event. We set potential price caps at points on the supply curve where customers’ have exhausted their flexible capacity. Using historical prices, we examine the systemic costs of these price caps, and present regulatory options for recouping them. Utilities and regulators interested in limiting consumer risk from dynamic pricing can utilize these methods to develop rate structures and encourage conservation.

The attached data upload allows for the duplication or modification of the analysis performed in this study.